How does Opay make Money?

Table of Contents

OPay Business Model

In wake of the year 2019, Opay took Nigeria by storm, by launching a perfectly executed mass-market takeover using freebies and aggressive marketing as its major means of customer acquisition.

2 years later, the question – How Opay make money still lingers.

This post is a deep dive into all there Is to the company, from revenue generation to understanding its business model.

Beyond digital advertising, Opay hired loads of agents that hit the streets distributing different gifts in exchange for an installation of their super app

OPay’s Mission

Making opportunities accessible to everyone

Delivering on the promise of financial inclusion in Africa today to safely connect people with the places, opportunities, and experiences that they truly care about.

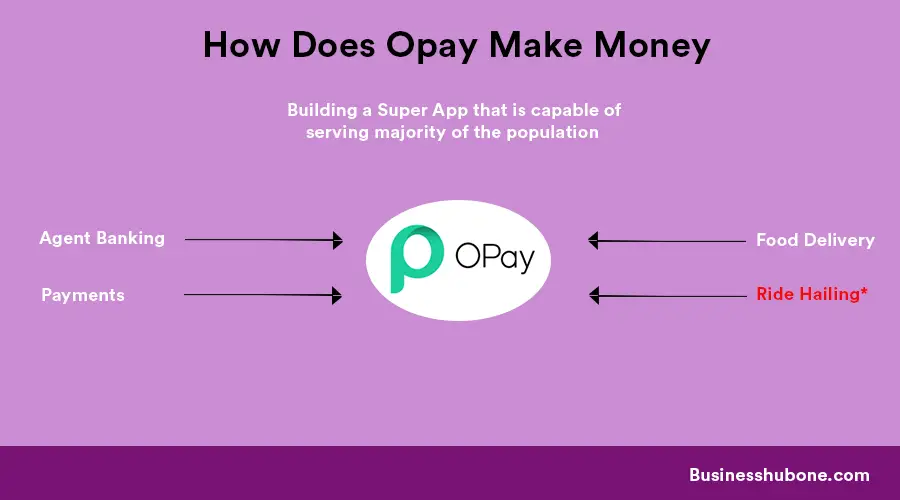

The Super App Ambition

In China, there is such a thing as super apps.

Super apps are apps that perform a lot of other functions usually unrelated, these apps are an ecosystem on their own and usually also include a platform for where third-party developers can create apps on top of their ecosystem.

Tencent Holdings Ltd.’s WeChat is a classic example of a super app. Aside from its basic function of sending messages, WeChat can also be used to order food, hail taxis and book plane tickets — not because Tencent offers these services, but because it allows third-party companies to create apps within WeChat.

While mobile users elsewhere use dedicated apps for specific tasks, mobile users in the Asia-Pacific region are accustomed to doing multiple, often seemingly unrelated functions, with just a single “super app.”

Opay set out to build a super app in the Nigerian Ecosystem. The original iteration for its app had features such as ride-hailing, food delivery, payments etc.

OPay is a one-stop mobile-based platform for payment, transportation, food & grocery delivery, and other important services in your everyday life.

Opay

Related: Starting a business in Nigeria

How does Opay make money?

Opay is a multi-faceted business that makes money from the various services it offers.

Opay makes money from commissions majorly, it only serves as a platform where other services can be easily accessed.

In Q3 2020, OPay processed a gross transaction value of $1.4 billion in October 2020, even though there is no independent way to verify those numbers, according to market share reports by TechCabal from NIBSS, OPay’s market share is around 70%. It is important to say that those NIBSS figures are also not a way to verify OPay’s transaction value.

By December OPay says it processed a gross transaction value of $2 billion in December alone, a 43% jump in two months.

OPay’s Revenue Structure

Ride-hailing* and Food Delivery*

* – now non-operational

The ride-hailing and food delivery ambition of the opay app has become non-operational for some time now. The company suffered a blow as a result of the new rules constituted by the Lagos state government, which represented the majority of its market.

In February 2020, The Lagos state government banned the usage of motorcycles as a means of public transportation on major highways in the state.

Payments

Payment is Big Business in Nigeria now. We have seen several fintech competitors spring up in the race to financial inclusion, Many commercial banks have also joined the frenzy in a bid to bank the unbanked.

Opay today now does $1 billion in monthly transactions and has 20 million active users.

Payments represent the core revenue generator for the company. Its platform gives you access to over 2000 billers including

- Betting platforms

- Government Bills

- Utilities

- Paying for products and services

- Online Shopping

- Hotel Booking etc

Agent Banking – OPay Merchants

According to market share reports by TechCabal from NIBSS, OPay’s market share is around 70%. It is important to say that those NIBSS figures are also not a way to verify OPay’s transaction value.

Through Agent banking, OPay looks to become a super aggregator that runs the majority of the financial transactions that happen in the country.

Related: Fintechs vs Traditional Banks

Loan – OKash and Creditme

OPay offers loans through OKash on its mobile app. These loans are mainly short-term payday loans that are available to salary earners as a cushion to their finances.

The interest on these loans is usually on the high side – 12% a month or 0.4% per day, however, they are a thing because nobody likes to be stranded.

The CreditMe product offers you the ability to make purchases in the OPay app even when you don’t have the funds at that moment. You can get a seven-day interest-free loan from CreditMe within minutes and make purchases or transfer to any account.

They charge 3% for this service

Savings and Investment

The platform has a savings and investment platform.

Savings and investments are a means to ensure the platform has some sort of operating cash.

How does the company spend money?

Initially, Opay had a really inefficient cost structure.

Acquiring customers through the freemium model was not a sustainable way of acquiring customers

In the freemium model, your customer acquisition cost will be very high while their lifetime value will be low. This would mean for every customer served you are burning through loads of cash.

The freemium model would prevent you from attracting the right customer to your business-

Related: What makes Great Brands?

Key stakeholders

In July 9 2019 Opay announced it had raised a $50 million series A led by IDG Capital, Sequoia Capital China, and Source Code Capital.

These companies are all based in China.

By November 2019, Opay went on to raise a Series B round of $120m, a total of 10 investors took part in this round including Source Code Capital, Bertelsmann Asia Investments, Softbank Ventures Asia etc

These investors and VC firms were also all based in China.

Opay Competitors

Almost every other Fintech brand is in close competition with the Opay brand.

Competition for the Opay brand cuts across different aspects of the Fintech Sector due to its super App ambition.

Some of them are Remita in government Payments, Cabon in Loans, Traditional banks, Piggyvest etc in savings

| Competitor | Service |

| Paga, FirstMonie | Agent Banking |

| Carbon | Loans |

| Traditional banks | Savings, Loans, Payments |

| Paystack | Payments |

| Remita | Government Agencies billing |

Core asset?

Consumers.

The key asset is the large consumer base the company has acquired through its agent banking and easy access to payments.

Future: How will OPay make money in the Future

Going Forward, OPay will look to become possibly the largest financial player in the African ecosystem. This will make it an essential partner for players in e-commerce, online shopping etc.

This kind of alliance can be seen in Alibaba. Except that they played the game the other way around. Alibaba built e-commerce first before spinning off payments in form of Ant financial off the e-commerce business.

2 Comments

Comments are closed.