FinTechs vs Banks Vs Telcos: Who will be Crowned Largest/best payment processor?

Table of Contents

The Payment Processing landscape

ISOs

Independent Sales Organizations (ISOs) sell credit card processing services to merchants, and they act as intermediaries between merchants, payment processors, and acquiring banks. In some cases, they might actually be banks; for example, Wells Fargo is a Fiserv ISO.

ISOs service merchant bank accounts and, at times, create the relationship between a merchant and bank in the first place. ISOs also lease point-of-sale terminals to merchants and may service customers who have problems with their cards. Because an ISO is not a bank, it does not physically manage merchants’ money and it’s also not regulated in the same way.

Issuers

Issuers are banks or other financial institutions that issue credit cards to consumers on behalf of the card networks. Specifically, these are the bank names that appear on credit cards, such as Chase or Bank of America. They also issue payment to the merchant’s bank (the acquiring bank) on behalf of their customers, which means they assume risk in the event that the customer is unable to pay their credit card balance.

issue mastecard, mpesa, opay

Aquirers/Process

An acquirer is a bank or financial institution that enables a merchant to accept credit card payments from a customer’s card-issuing bank within a credit card network. These are typically referred to as merchant acquirers. An acquirer primarily processes credit or debit card payments on behalf of a merchant, but they can also be either a payment processor or an Independent Sales Organization (ISO)—Elavon is one such example of an acquiring bank that’s also a payment processor. The acquirer assumes the risk and passes the merchant’s transaction information on to the card brand associations (the card networks), and the issuers, to complete the payment.

Related: Importance of Cash Flow in Business

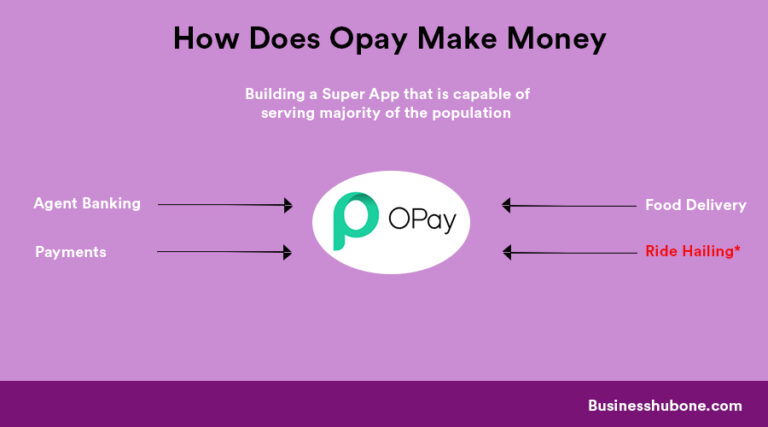

Case Study: Nigeria Payments Landscape

The FinTech Advantage

FinTechs have considerable advantage over both traditional banks and

Purpose

Fintechs have the luxury of having well-defined objectives when entering the markets as opposed to banks or Telcos that have bigger traditional duties that must be carried out irrespective of their vision to capture as much of payment processing as they like.

Market dominance works on the principle of fixing frictions and he that is able to fix the ost important or relevant frictions will dominate the market. The early defined purpose of startups in fixing particular frictions rather than broader outlook of the markets surely gives them an edge

Consumer relations

With the advent of technology, there are lots of avenues for banks to reach out to existing customers

The Telco Advantage

Reach

In Africa, the race to payment processing is a very unique one. There is about 18% Internet penetration but over 80% mobile penetration. This 80% that are connected on mobile represent over 960 million people who have phones. and Telecommunications have a huge advantage.

Nigeria is not left out of this high GSM penetration with 195 million active mobile subscribers while internet subscribers are only and MTN, the Largest network in Nigeria, single-handedly has about 64.3 million subscribers. This huge subscriber base will serve as a huge headstart for their goal of driving payment processing.

Traditional Bank Advantage

Experience

The Traditional bank more often than not have been around for longer than most telecommuncation companies and Fintechs. this naturall means they have better understanding of the market and

Trust

Alat started with the digital bank propaganda and added 180 thousand customers. This is simply a leverage on the over 70 years of operation of its parent Wema bank. It does not require a ton of publicity for the world to believe in their vision

Disadvantage

Process

Banks are biger entities and generally go throuh a lot of process to make decisons as it takes time to navigate the bureaucrtic landscape that as been formed over the years.

Winning the payment processing race has a lot to do with rapid innovation, adoption of technologies that traditional banks may not be too familiar with and

Digital Village influence

The unboxing of territories has unleashed new competition for struggling/not-so-buoyant local entities. This unboxing has been made possible with the advent of the internet successfully eliminating geographical barriers and allowing goods, services and just about anything be sold across international waters.

In India, the big Tech companies arrived with their big war chest to get a piece of the vastly growing population. Facebook has also identified as one of the few to identify the potential in the Nigerian Market and made efforts to get a piece of it. The first effort was the proposed subsea cable that aims to increase the speed of broadband in the country to acceptable levels and open an office in Nigeria (The second office in Africa) by 2021.

Case Study: United States

The Landscape is a bit broader in the United States with tech companies also bringing their massive

The FinTech Advantage

As at February 2020, there wer 8,775 financial technology (Fintech) startups in the Americans in February 2020, making it the region with the most Fintech startups globally.

Tech Companies

The big Tech companies have also become big players in the payment indistry. Tech companies such as Apple have Apple pay, Amazon has Amazon pay google has its own google pay, Facebook is launching its own facebook pay

The Tech Advantage

Ecosystem

There almost a billion apple phones with access to its appstore, itunes store and all making purchases

The Telco Advantage

The telecommunication companies also have their own advantage hinged on their business model

Traditional/Investment Bank Advantage

This big banks surely have an advantage

Winning the Race to Payment Processing

The Criteria to winning the payment transformation is expected to hinge largely on technology, however, the advent of such words as API’s has made sure technology is nothing but a commodity that can be bought and sold wither in form of hiring the manpower behind it or buying the business that holds that owns the technology.

Who will win?

Lets discuss in the comments section!

i would love to hear from you

2 Comments