Top 10 Investment opportunities in Nigeria

One perk this list promise is simplicity of approach. This list was initially promised to be a list of 20 investment opportunities in Nigeria- However, there is no pressure to have so many investments and having headache managing them, rather have high performing investments that can be managed properly.

You only need 5 high performing consistent stocks in your lifetime.

Warren Buffet, Chairman, Berkshire Hathaway

The primary reason is however lack of high quality opportunities that could be truly called investment opportunities.

Let’s ride.

Disclaimer: Note this does not constitute investment advise in any way

Table of Contents

Top 10 Investment opportunities in Nigeria

These are the top 10 investment opportunities in Nigeria

- Real Estate

- Stocks

- Mutual Funds

- Exchange-traded funds

- Treasury Bills

- Government Bonds

- Forex

- Fixed deposit account

- Investing in Startups or small business

- Starting a Business.

1. Real Estate

In the world and of course Nigeria, real estate remains of the to and most consistent investment opportunities.

In Nigeria, it mostly is being used as a means of stabilization and diversification of wealth – because of the inaccessibility of credit, it is almost impossible for someone to rise from the blues and become a millionaire – even in Naira – as a direct result of real estate investments.

Current use-case

- Most people buy land and resell

- Some buy, develop and rent it out

- Some buy houses, tush it up for other uses or to resel

How then to go about it?

The easiest way is to get capital and buy the land and resell. However this requires a lot of speculation in order to get good return on your investment.

I’ll give an example of a piece of land in 2001, It cost about 20,000 naira per plot that year and took about 10 years to reach 300k per plot. If another is not too distant from the area had been chosen, it would have gotten to that price in less time.

2. Stocks

These are ownership interests in a particular company. The advent of the internet, automated trading, and decentralization of the cumbersome stock trading infrastructure has made sure that investing in stocks can be made by just anybody.

3. Mutual Funds

A Mutual Fund is an investment vehicle made up of a pool of funds collected from numerous investors for the purpose of investing in securities such as stocks, bonds, money market instruments, and similar assets

Mutual funds represent decent returns with minimal risks. A return on investment of about 10% per annum is obtainable with most mutual funds.

4. Exchange traded funds

Exchange-traded funds differ from mutual funds different from mutual funds.

Exchange-Traded Funds (ETFs) are securities that track the performance of an index or basket of assets. They are listed on an exchange and traded much like stocks. ETFs derive their performance from the index or underlying assets they track.

5. Treasury Bills

Th government approaches the financial markets to raise money in two different ways. One of them is treasury bills- they are issued when the government needs money for a short period of time

In the last 10 years, the interest on treasury bills has been consistently in the decline – this is due to no ther reason – the government is trying to encourage investments in businesses over idling money in other money instruments.

Nigerian Treasury bill (NTB) in the last 10 years

They are issued with different maturation dates 91 days, 182 days and 364 days. Interest rates differ depending on the length of days.

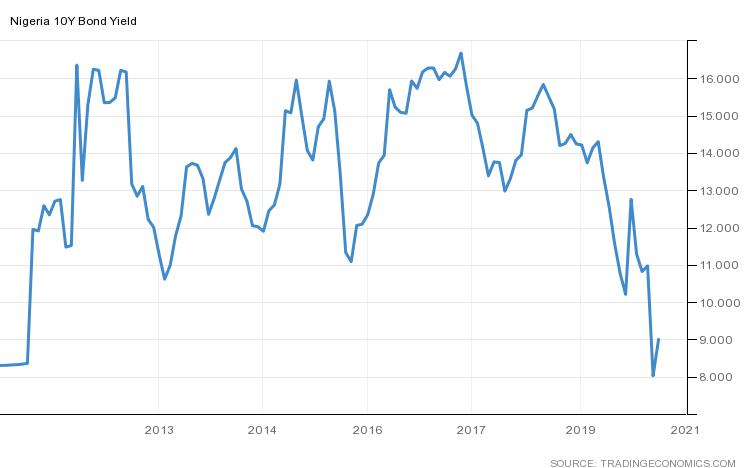

6. Government bonds

The other way the government approaches the financial markets to raise money is by issuing bonds. Government bonds are issued when the government needs money for a longer period of time.

Government bonds is one of the safest money instruments as it will take a whole country to become non-existent for your cheque to bounce.

7. Forex

This is probably the riskiest of all the investment opportunities, I know you must have been expecting this much earlier on, or you even downloaded this resource to get a perspective on this new venture that everywhere is buzzing about.

First off

- Learn

- Be Patient

The learning curve for FOREX is quite large and most times several people rush at the promise of changed status that they do not pay enough attention to details.

There is limited resource that talks about FOREX for what it actually is, there is plenty of crap claiming to teach Forex outside.

The moment you parade Forex as a get rich quick scheme rather as a get rich scheme, you have laid a fundamental foundation for failure at the enterprise.

Demo trading is not Real trading

Your excellent demo results will never translate to excellent live trading results.

Your success in demo trading is only indicative that you have learned a particular strategy and understood the terminologies used in the market.

You now begin to learn psychology, mastering emotions, sticking to trading plans, profit targets and the whole process of becoming a disciplined trader without which you cannot make any decent success

Go to Crackingfx Academy to take a course, I will totally recommend to train yourself in the art of forex trading and get rich quick.

8. Fixed deposit accounts

At certain levels of wealth, the best investment you can make are the ones that guarantee that your money is secure no matter the circumstances.

Fixed deposit account can guarantee this. The rates might not be too high but it’s too high.

Check out this article on Fixed deposit rates in Nigerian Banks. You can reach out to your account officer to get the rates that applies in your bank.

9. Investing in Startup/Small Businesses

If you can do the due diligence in getting to know the person and understanding the business model and establish a clear path for th business to accept ne money

This small business represents massive profit advantages sometimes reaching as much as 100% within very short periods ranging from 1 month to a few months

I once invested in a small business, started by a novice in the particular(He saw the opportunity and reached out to me to finance the idea) and I got 60% ROI within 8 weeks

That’s very impressive!

The downside of theîs model is you cannot pour even 1 million in some of these businesses as they are not built to absorb them.

For example, Find that tailor in your area, get to know their business, offer to help with small cash, you will be amazed at how fast and how much interest they will be willing to offer you on to of your capital.

Related: Startups or Small Business: understanding your venture

10. Starting a Business

This is also an investment opportunity, starting a business in the 21st century does not require your ultimate presence.

The no. 1 feature of an investment is the ability for it to make money for you with little or no presence.

Find that business that fits your capital, schedule, and skill set and begin to build in a way that ensures that it operates as an investment and not as one that ensures you are there 24/7.

Bonus

11. Yourself

By far one of the best investment you can make is in yourself. Learn a new skill, develop yourself personally and professionally. This proves to be a springboard for a lot of other opportunities going forward.

Lastly,

Investing in any venture carries a certain amount of risk, intelligent investing is understanding the perfect balance between the risk you are open to and the profits that are acceptable by you.

Invest safely!

2 Comments