Taxation in Nigeria: Complete guide to Corporate Tax

Taxation is a significant consideration for founders who look to start their business in Nigeria or investors who look to invest in Nigeria. Taxes are fees levied by the government on individuals and companies to generate revenue for the running of the country.

Table of Contents

Tax

There has three attributes

- Validated by law

- Not a voluntary payment

- Not a payment for a particular service

Taxes are payable by law, they are not voluntary payment and not payment for a particular service – You cannot say this is what your tax should be used for pr this is how you want your own tax to be spent.

Related: Starting a Business in Nigeria: The ultimate playbook

Single country model

In the 1900s when taxes were in first introduced, it was almost impossible for companies to operate in several countries. Hence tax laws were formulated in individual countries and paid as such.

Multi-Nation model

As the years went by, and the barriers between countries became increasingly insignificant and technology, efficient means of transportation made it easier to do business in multiple countries, many companies began to operate in multiple countries.

Tax treaties

The operation of companies in multiple countries presented a problem – Multiple taxations.

Tax treaties are signed between countries in order to promote worldwide economic development and prevent companies from double taxation on the production and sale of particular goods across international borders.

Tax treaties are models for countries to play catch up with the international model of businesses.

The Organization for Economic Cooperation and Development (OECD) and the United Nations developed model Conventions (model double tax treaties) on Income and Capital. These models define the principles of a permanent establishment, allocates taxing rights amongst nations and provides a basis of information sharing and dispute resolution between contracting states.

In Nigeria, the OECD model serves as the basis on which most of the current double taxation treaties (DTTs) with other countries have been formulated. Nigeria currently has double taxation treaties with thirteen countries: The United Kingdom, The Netherlands, Canada, South Africa, China, Philippines, Pakistan, Romania, Belgium, France, Mauritius, South- Korea, and Italy.

These tax treaties are comprehensive except the treaty with Italy which covers Air and shipping agreement only.

Related: GDP and startups: Correlations and opportunities for growth

Taxation in Nigeria

The tax legislation has been constantly amended and modified. According to the most recent legislation, here are the tax bases and their relevant taxes:

- Individuals (Personal Income Tax; Development Levy);

- Corporate entities (Companies Income Tax; Petroleum Profits Tax; Education Tax; Technology Levy);

- Transactions (Value Added Tax; Capital Gains Tax;

- Stamp Duty; Excise Duty; Import Duty; Export Duty);

- Assets (Property Tax, etc.)

Company Income Tax(CIT)

Company income tax is a compulsory levy on the profits or income of the organization levied only to the Federal Inland Revenue Service(FIRS)

The CIT rate is 30% for large companies (i.e. companies with gross turnover greater than NGN 100 million), assessed on a preceding year basis (i.e. tax is charged on profits for the accounting year ending in the year preceding assessment).

Small company rates

The CIT rate is 0% for companies with gross turnover of NGN 25 million or less.

Medium company rates

The CIT rate is 20% for companies with gross turnover greater than NGN 25 million and less than NGN 100 million.

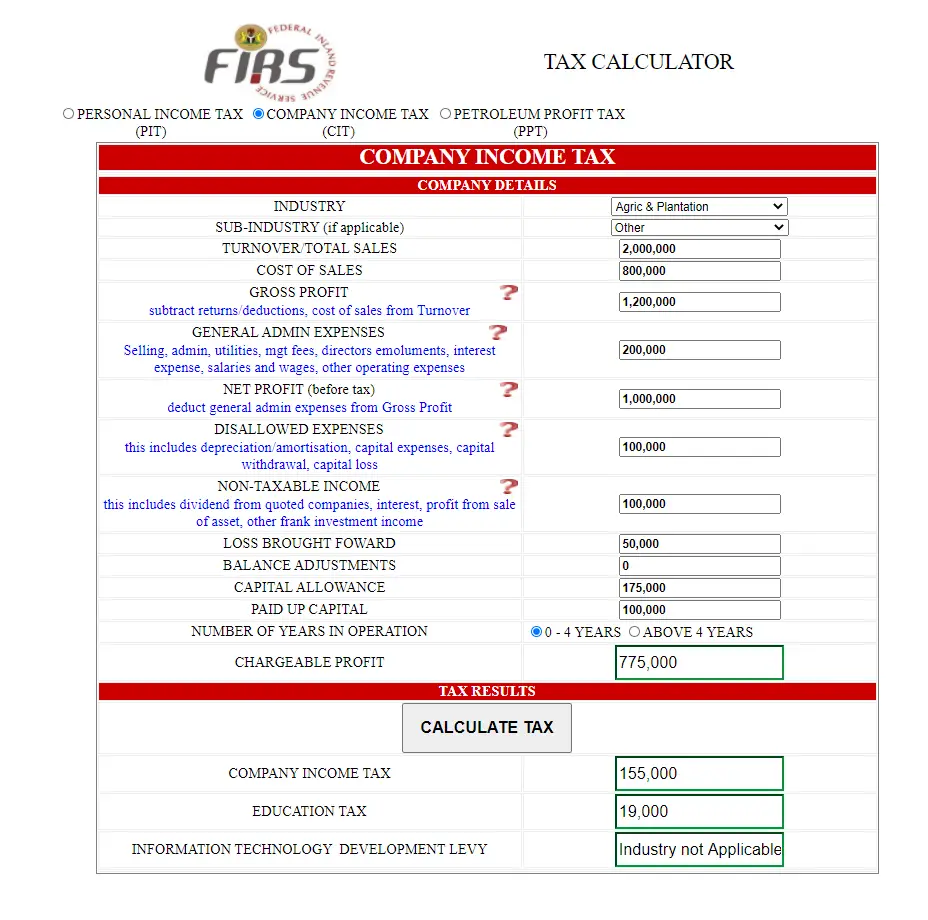

How to calculate Company Income Tax(C.I.T.)

The FIRS have incorporated an automatic easy to use tax calculator on their website

Calculate your Company Income Tax

Do I need to pay tax?

All companies must file self-assessment returns with the FIRS whether exempted from incorporation or not liable to pay tax

Compliance Modalities

Not filing will attract a fine or applicable punishment as stated in the acts that binds taxation.

Older Companies are expected to pay their taxes Six(6) months after the accounting year, while Newer companies par taxes eighteen(18) months from start date or 6 months from first accounting period, which ever comes first.

E-filing

Electronic filing is part of the Integrated tax administration system((ITAS) an effort of the tax body in Nigeria(FIRS) to ensure there is flexibility in the tax payment system to ensure ease in payment for taxpayers and subsequent increase in the compliance rate.

Procedure

- Download form

- Get document number – the number is unique to Taxpayers, tax type, tax period and tax office

- Proceed to pay using the document number

Other Modalities and forms of Company Taxation

Real Estate Investment Companies

Real Estate Investment Companies approved by the Securities Exchange Commission to operate as a real estate investment scheme in Nigeria will be exempt from income tax on rental income, and dividend income earned in a financial year will be exempt from income tax provided that at least 75% of such income is distributed within 12 months.

Petroleum profit tax (PPT)

PPT is a tax on the income of companies engaged in upstream petroleum operations in lieu of CIT.

The PPT rates vary as follows:

- 50% for petroleum operations under production sharing contracts (PSC) with the Nigerian National Petroleum Corporation (NNPC).

- 65.75% for non-PSC operations, including joint ventures (JVs), in the first five years during which the company has not fully amortised all pre-production capitalised expenditure.

- 85% for non-PSC operations after the first five years.

Tertiary education tax

Tertiary education tax is imposed on every Nigerian resident company at the rate of 2% of the assessable profit for each year of assessment. The tax is payable within two months of an assessment notice from the FIRS. In practice, many companies pay the tax on a self-assessment basis along with their CIT.

For companies subject to PPT, tertiary education tax is to be treated as an allowable deduction. For other companies, income/profit taxes are not deductible in arriving at taxable income. Non-resident companies and unincorporated entities are exempt from tertiary education tax.

Minimum tax

Minimum tax is payable by companies having no taxable profits for the year or where the tax on profits is below the minimum tax. However, companies in the first four calendar years of business, companies engaged in the agriculture business, or small companies are exempt from minimum tax.

Minimum tax payable is calculated as 0.5% of gross turnover less franked investment income.

For non-life insurance companies, minimum tax is calculated as 0.5% of gross premium.

For life insurance companies, minimum tax is calculated as 0.5% of gross income.

Local income taxes

CIT is payable only to the federal government. State governments collect income taxes of individuals and unincorporated entities, while local governments are only allowed to collect levies and rates but not income tax.

Challenges of Nigeria Tax System

Despite the potentials of taxation as a dynamic tool for sustainable national development, Nigeria tax system has been unable to achieve its objectives due to the following challenges, among others:

Inefficient Tax laws

The tax system in Nigeria lacks the robust framework for the taxation of the informal sector and high net worth individuals, this limits the revenue base and thus creates inequity.

The non-regular review of tax legislation, which has led to obsolete laws, that do not reflect current economic realities; and

Poor Tax administration system

The administration of taxes can only boast of a fragmented database of taxpayers, this weak structure for the exchange of information by and with tax authorities, results in revenue leakage and the use of aggressive and unorthodox methods for tax collection.

Insufficient capacity has led to the delegation of powers of revenue officials to third parties, thereby creating complications in the tax system. Poor accountability for tax revenue and failure by tax authorities to honor refund obligations to taxpayers.

Fragmented Governance

There evident disintegration and lack of communication between the levels of government in Nigeria and lack of clarity on taxation powers of each level of government and encroachment on the powers of one level of government by another;

This disjointed governance, unclear tax powers coupled with inordinate drive by all tiers of government to grow internally generated revenue leads to the arbitrary exercise of regulatory powers for revenue purpose.

Related: Ease of doing Business in Nigeria 2020

Conclusion,

Taxation and all the supporting framework in Nigeria have been constantly improving over the years and gradually confirming to international standard.

Pay close attention to taxes as you grow your Business!

Disclaimer: This article is purely informative and does not constitute any legal advice.

One Comment

Comments are closed.