Opay PoS vs Moniepoint PoS: Which is better?

Point of sale terminal is a device that is used to accept payments from customers usually for retail transactions. PoS terminals are used by small, medium and large enterprises.

Modern PoS systems are indifferent forms and are a combination of hardware and software, often including a barcode scanner, card reader, cash drawer, and receipt printer. In Nigeria, what comes to mind when you mention PoS are card readers that are used with ATM cards in performing transactions.

Table of Contents

Opay

OPay is a mobile-based platform that provides a range of essential services including payments, transfers, loans, savings, and more, to individuals. Presently, OPay has over 18 million registered app users and 500,000 agents in Nigeria who depend on its services for various activities such as money transfers, bill payments, and others.

OPay Digital Services Limited is an entity established by the Opera Norway AS Group, which operates in developing markets spanning Asia, Africa, and Latin America, including countries such as Mexico, Nigeria, Egypt, and Pakistan.

Related: Opay vs Palmpay

Opay PoS

Opay PoS are of three types, small card readers, traditional PoS with button input and Android PoS with touchscreen. The prices vary depending on the PoS type that you intend to buy,

Related: How does Opay Make Money

Moniepoint

Moniepoint formerly Teamapt is one of the leading fintech companies in Nigeria. They have over time evolved to become the number one fintech in the agency banking sector.

Moniepoint has over 600 thousand agents and processes more than 7 trillion Naira monthly. They also claim their network has a 99% uptime rating.

Related: Team Apt rebrands as Moniepoint

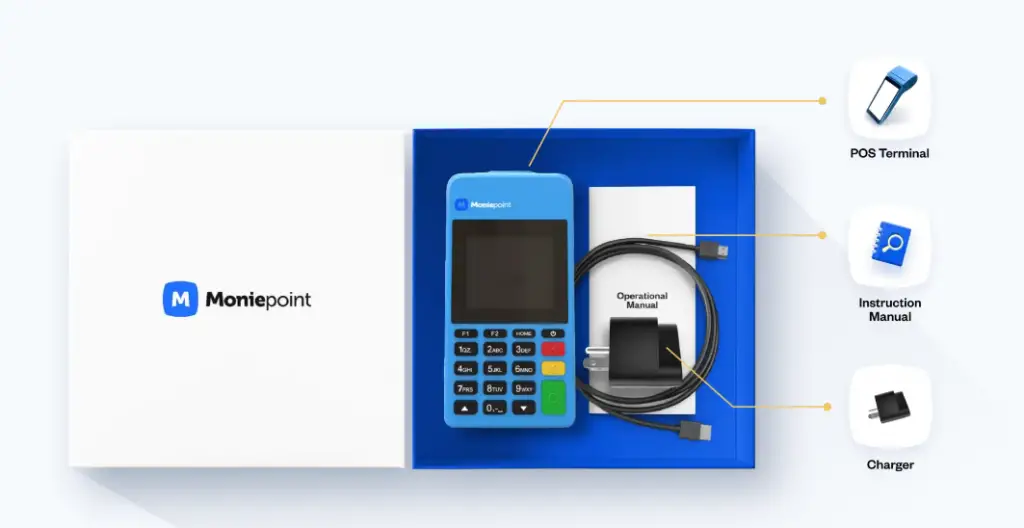

MoniePoint PoS

Moniepoint PoS is majorly the traditional button input PoS. The PoS is durable and can be found at almost any agency banking stall across Nigeria.

Opay PoS vs Moniepoint PoS

Opay PoS and Moniepoint PoS are both leading PoS terminal providers in Nigeria which are largely reliable in accepting payments from customers and have robust agency banking features. This article is a deep delve into comparing the different features of these two PoS terminals under different topics of consideration e.g cost, charges, customer service etc.

Both OPay PoS and Moniepoint PoS are relatively easy to acquire, they charge a similar 0.5% for every transaction capped at 100 Naira and offer competitive network uptime. Find out the deal-breaker below.

In comparing Opay, we will be examining the two PoS terminals under 7 main topics of discussion which are Network, Cost of acquisition, Charges, Reliability, Customer Service, Durability and Features.

Network

Opay PoS is reliable in network connectivity with automatic reversals in place in the event of downtime.

Moniepoint boasts 99% uptime in network connectivity. There is a famous saying that if your card does not work on a Moniepoint PoS it is more than likely that it will not work on any other PoS terminal in the country. In a country where electronic transactions are prone to a myriad of errors that claim has proved to be the truth more often than not.

Cost of acquisition

Opay PoS costs ₦45000. The cost is outright payment for the PoS which means you as a merchant do not have minimum targets to meet while using the PoS.

Moniepoint PoS costs ₦21,500. The ₦21,500 covers a ₦10,000 caution fee, ₦10,000 logistics fee, and ₦1,500 insurance fee for 1 year.

Charges

Moniepoint charges 0.5% per transaction capped at 100 Naira. Opay also charges 0.5% per transaction capped at 100 Naira.

Customer service

Moniepoint has excellent customer service that tries to meet agents where they are. Moniepoint has a dedicated WhatsApp group for agents these groups are helpful in the fast resolution of dispute errors and getting answers to issues in the line of work.

It can be a little difficult to reach Opay customer service and you don’t get the same customer experience like you would with Moniepoint. You will typically need to wait for longer to resolve issues compared to Moniepoint

Durability

Both Opay PoS and Moniepoint are durable. Electronic devices can be prone to damage due to different reasons, but largely the Pos terminals from both companies are durable with decent battery life.

Table comparing Opay Pos and Moniepoint PoS

| Criteria | Moniepoint PoS | Opay PoS |

| Network | 4.5 | 4.5 |

| Cost of acquisition | ₦21,500 | ₦45000 |

| Charges | 0.5% capped at 100 naira | 0.5% capped at 100 naira |

| Durability | 4.2 | 4,5 |

| Customer service | 4.0 | 4.7 |

| Features |

How to get Opay PoS

- Create an Opay account

- Activate your account and upgrade your account to a Merchant account

- Request for a new PoS

- Get your PoS and branded items for branding to let people know you now accept Opay as a means of payment.

How to get MoniePoint PoS

- Create a business account and log in

- Request a new PoS

Click on the Add a new PoS button and follow the instructions - Fund your account and pay for the terminal

Fund your newly created Business Account with a minimum of ₦21,500 for the POS Terminal and complete the request. The ₦21,500 covers a ₦10,000 caution fee, ₦10,000 logistics fee, and ₦1,500 insurance fee for 1 year. - Get your POS delivered within 48 hours

You will be instantly assigned a dedicated Relationship Manager from Moniepoint. The Relationship Manager will deliver the POS terminal to you within 48 hours, train you on how to use the terminal and answer any questions you may have.

Features of PoS Terminals

Opay PoS

- Bank Transfer

- Deposit

- Withdrawal

- Bills Payment

Moniepoint PoS

- Bank Transfer

- Deposit

- Withdrawal

- Bills Payment

Conclusion: Opay PoS vs Moniepoint PoS

Both OPay PoS and Moniepoint PoS are relatively easy to acquire, they charge a similar 0.5% for every transaction capped at 100 Naira. Moniepoint only slightly edges Opay on the grounds of customer service and durability.