Nigeria: The story of repressive recessions

Nigeria has literally struggled since independence!

The cycle of Nigeria’s prosperity and mostly otherwise comes in about cycles with growth occurring some of the time and recession taking place almost every other time.

For most of her life, Oil has been the mainstay of the Nigerian economy accounting for over 90% of her revenue.

This, extreme oil dependence, represents the biggest single threat to the stability and/or growth of the revenue of the country and unavoidably led us into recession any time the price of crude oil dropped.

Below is a graph showing the GDP of the Nigerian Economy from independence up till 2020.

source: tradingeconomics.com

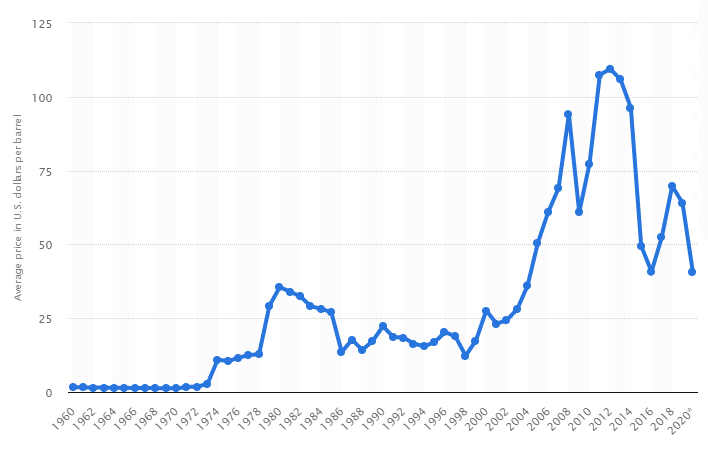

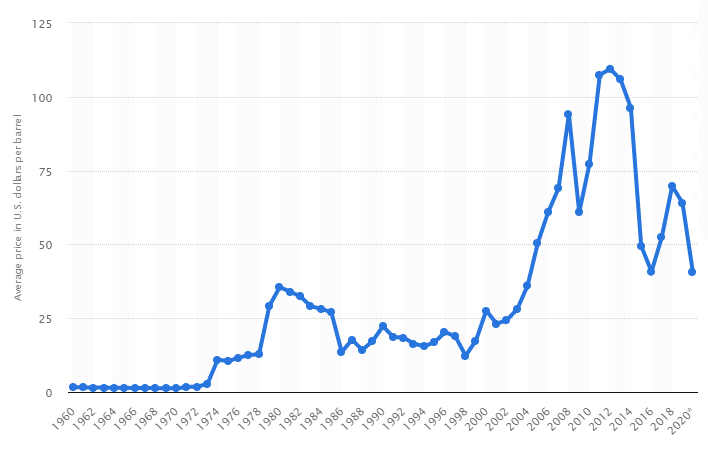

The graph of the crude oil prices from 1960 -2020 is shown below

Upon close observation, the price of crude oil and the increase in the GDP of Nigeria is closely related.

For every rise or fall in the price of crude oil there is a corresponding movement in the value of the GDP of the Nigerian Economy.

Table of Contents

Recession

Recession is a period of significant decline in general economic activity usually pronounced in income and expenditure.

A country is said to be in recession if it records negative economic growth rates for two consecutive quarters.

Nigeria and Recession

Nigeria slipped into its worst economic crisis in 2016 when is recorded negative economic growth rates of -0.36% and -2.06% in the first and second quarters of 2016 respectively.

There was a significant fall in National income as crude oil prices were at its bare lowest, trading as low as $30 per barrel.

Did Nigeria leave recession since 2016?

The Nigerian economy has been experiencing a contraction since 2016 with the economy experiencing a slight recovery in 2018/2019 and plunging right back in 2020 under the impact of the COVID-19 Pandemic.

The pandemic impeded economic activities and prevented the economy from continuing in the path of recovery it was beginning to take.

Nigeria’s GDP up until 2020 was at sub-2015 levels. Largely, it can be said that the economy is yet to recover from the recession it experienced in 2016.

Direct Causes of Recession

1. Reduction in Crude oil Prices

Every fall in the price of crude oil has taken an almost equal toll on the GDP of Nigeria. This sort of direct response from one singular response has been a major reason keeping Nigeria in recession and sending us back each time we try to struggle out of it.

Related: GDP and and startups: Correlations and opportunities for growth

2. Drop in Crude oil Production

By direct inference, any drop in the numberof barrels of crude oil that the nation s able to produce has a direct impact on the revenue of the country.

The dips in the graph below correspond to the dips in the GDP of the country.

source: tradingeconomics.com

3. Depleted foreign exchange reserve

Foreign exchange reserve is cash and other assets such as gold held by the central bank to balance payments of the country.

The foreign exchange reserves of a country is meant to serve as its cushion

source: tradingeconomics.com

Remote Causes of Recession

1. Cost of Governance

Decade after decade, year after year the cost of governance in Nigeria keeps going higher and higher. The rising population means an increase in governmental responsibilities, increasing insecurity and need to invest in improving the welfare of the population.

The government of the day(2020) has comfortably devoted a significant part of the yearly budget to defense- fighting insurgency and improving security.

The negligence of other sectors of the economy has led to a gross increase in the unemployment rate, poor living standards and invariably leading the country into an economic recession.

2. Poor Infrastructure

Over the several decades of existence, Nigeria has failed to develop infrastructure that are capable of catering for her ever increasing population. The very limited infrsatructure that were luckily created over the course of those years have mostly fallen into a state of disrepair making them function a lot below their capacity.

This menace has significantly added to how Nigeria has slipped into recession.

3. Corruption

Corruption is one tricky plague that the present administration 2015-2023 had pledged to get rid of over the course of its tenure.

However, the cost of fighting corruption is such an enormous cost that a country is better off trying to build fundamental systems than fighting the plague of corruption itself.

Stagflation

The combined influence of recession and gross inflation on an economy is known as Stagflation.

The Nigerian fell into a period of falling output, rising unemployment, ever increasing price level.

Moving out of recession

Moving out of recession for Nigeria is going to be a long term effort. There will be a need to go back to the drawing board and prioritize the sectors and actions that will solve the effects of recession in fast ways.

There are a few sectors that meets this description

Agriculture

Agriculture is a high interest sector that can drive massive growth for the Nigerian Economy. The vast majority of the land is arable and there is a teeming young population that are available to put in the manpower to work, if the condition are right.

Related: Starting a Business in Nigeria

Manufacturing

Manufacturing is also an high income sector that can rapidly drive growth in the Nigerian. The export of goods in their raw for is easily the worst form of capital flight that can plague an economy.

The payment for manufactured products generally exceeds the value of the raw material by many folds, the export of former will improve national wealth faster than the export of the latter.

In Nigeria almost all of our raw materials are exported before the finished products are then imported. this act has consistently kept our economy under water.

Paying good attention to these two sectors can easily and effortlessly pull Nigeria out of recession.

Related: True Cost of Inflation in Nigeria!

The role of Good Policies

The recession in Nigeria was aggravated by administrative and policy laxities.

In the words of former Vice President of the World Bank, Mrs Oby Ezekwesili “while the Jonathan administration failed to do something about the impending recession before leaving office, the government of his successor failed to launch a comprehensive fiscal stabilization program on the assumption of office in May 2015”.

Most of the policies made by the Nigerian government has been focused on the development of the oil sector, subsidizing one thing or the other and fine tuning import of the many commodities that can easily be produced in the country.

The policy formulations in Nigeria has to go on to begin to cater for the sectors that can improve the economy significantly and stop being mere propaganda.