FairMoney vs Carbon

Digital lending companies are financial technology (fintech) companies that provide loans to individuals and businesses through digital platforms. In Nigeria, digital lending has gained significant popularity in recent years due to the high demand for credit and the limited access to traditional banking services.

There are several digital lending companies in Nigeria, including Carbon, Renmoney, KiaKia, FairMoney, and Branch. These companies offer loans through mobile applications or websites, and customers can apply for loans and receive funds within minutes.

Digital lending companies in Nigeria leverage data analytics and machine learning algorithms to evaluate borrowers’ creditworthiness and offer loans at competitive interest rates. They typically provide small-ticket loans, ranging from NGN 1,000 to NGN 500,000, with repayment tenures ranging from a few days to a few months.

In this article, we will be taking a critical look at FairMoney and Carbon with special attention to their loan product

Table of Contents

Fairmoney loan vs Carbon loan: Which loan is easier to obtain?

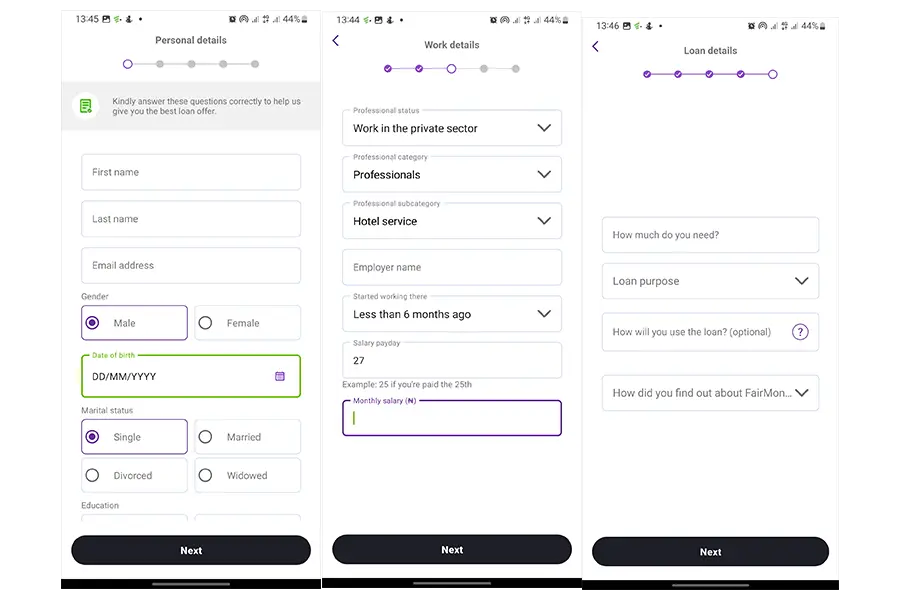

FairMoney loan application

- Fill out the online loan application form

The fairmoney loan application form is a little long however the questions are basic and very easy to fill out and submit.

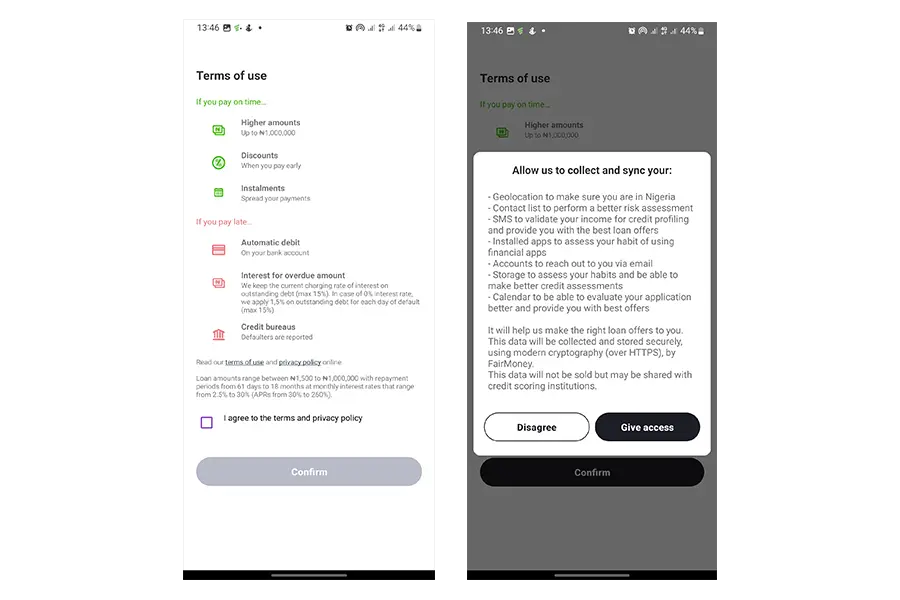

2. Accept the terms of service and grant permissions

After filling the online application form, you will need to accept the terms of service and also give the app permission to access different services on your phones. The fairmoney app also requires permission access to your contacts, storage etc.

Below is a list of services you need to grant to successfully obtaina a loan and a short explanation of wny thy require the information.

- Geolocation -to make sure you are in Nigeria

- Contact list to perform a better risk assessment – SMS to validate your income for credit profiling and provide you with the best loan offers – Installed apps to assess your habit of using financial apps – Accounts to reach out to you via email

- Storage to assess your habits and be able to make better credit assessments – Calendar to be able to evaluate your application better and provide you with best offers.

Loan amounts range between ₦1,500 to ₦1,000,000 with repayment periods from 61 days to 18 months at monthly low interest rates that range from 2.5% to 30% (APRs from 30% to 260%)

💸 Loan characteristics

Online Loan amount from ₦1,500 to ₦1,000,000

- No collateral required

- 100% digital application & fast loan disbursements

- Repayment periods from 61 days to 18 months

- APR from 30% to 260% per annum

- Interest discounts of up to 90% for early repayments

- No hidden fees

💸 An example of a FairMoney loan

Borrow ₦100,000 over 3 months

Interest (total cost of the loan): ₦30,000 (30% rate)

Three monthly repayments: ₦43,333

Total amount payable: ₦130,000

Representative: 120% APR

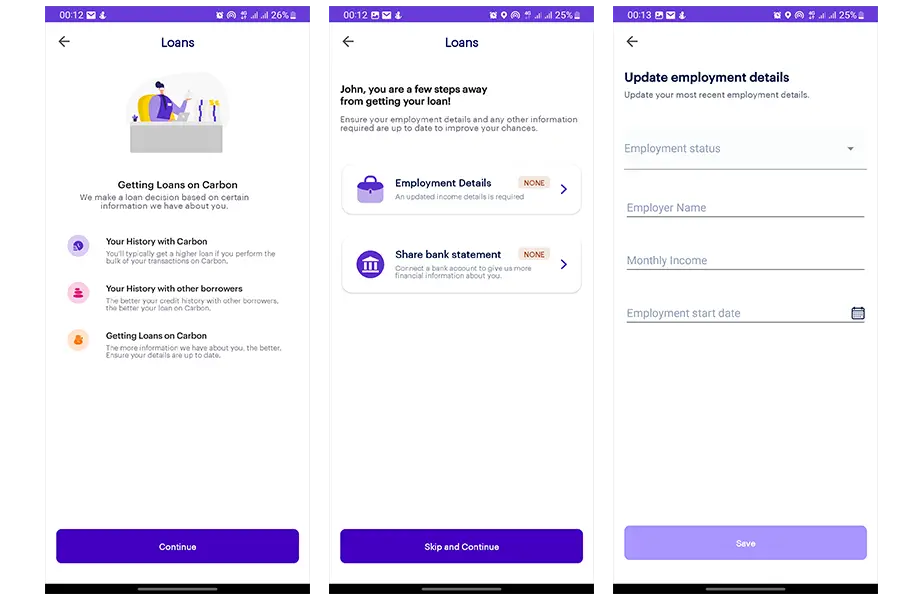

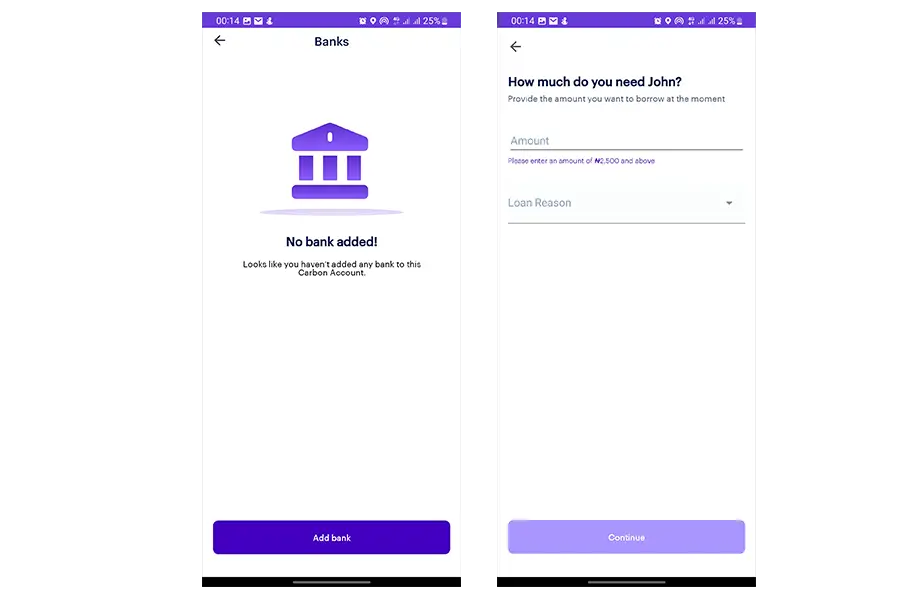

Carbon loan application

Carbon loan application process is in two major sections. Employee verification and bank account verification. Carbon uses both verifications to determine your eligibility in paying back these loans.

Carbon uses Remita to perform bank account verification. These verification uses analysis of your bank account to try to determine your cashflow and calculate the amount that they can obtain and pay back without defaulting.

Carbon Loan characteristics

Online Loan amount from ₦2,500 to ₦1,000,000

- No collateral required

- 100% digital application & fast loan disbursements

- No hidden fees

💸 An example of a Carbon loan

Borrow ₦100,000 over 3 months

Interest (total cost of the loan): ₦30,000 (30% rate)

Three monthly repayments

FairMoney vs Carbon: Other services

Other FairMoney features

- FairMoney Savings

- FairMoney Airtime and Bill Purchase

Other Carbon features

Carbon Zero

Carbon zero allows you to buy any product from selected merchants with a repayment plan, The payment options are flexible and can be between 1 to 6 months. the first 1-3 months is completely free while 4-6 months attract a 3% fee.

- Carbon debit card

- Carbon credit report

- Carbon SME loans

- Carbon savings

Comparison table: Fairmoney vs Carbon

| Feature | Fairmoney | Carbon |

|---|---|---|

| Interest rate (Loans) | ₦1500 – ₦1,000,000 2.5% – 30% (Monthly) Annual Percentage Rate (30% – 260%) Late payment: 1.5% daily capped at 15% | ₦2500 – ₦1,000,000 2.5% to 30% |

| Interest rate (savings) | 10% per annum | 9% – 15.5% per annum depending on duration |

| App Store Rating | 4.4(555k reviews) | 4.4 (139k reviews) |

| Number of downloads | 10M+ 10 Oct 2017 | 1M+ 18 May 2016 |

| Compatibility | Android 5.0 and above | Android 7.0 and above |

| App size | 17MB | 87MB |

| Loan amount | ₦2500 – ₦1,000,000 | ₦2500 – ₦1,000,000 |

| Qualification leniency | Medium | Medium |

| Perks and Bonuses | Free transfers, 3% cashback on airtime and bills payment | 1% cashback on debit card spending |

| App Usability | Easy to use | Easy to use |

How reliable is FairMoney?

FairMoney is a Microfinance bank in Nigeria and reliable to the extent of insurance that CBN regulations allow for microfinance banks.

Is Fairmoney legit?

FairMoney Microfinance bank is licensed by the Central bank of Nigeria as a Microfinance bank and customers deposits is insured by the Nigeria deposit insurance commission (NDIC)

How reliable is carbon

Carbon is a Microfinance bank in Nigeria and reliable to the extent of insurance that CBN regulations allow for microfinance banks.

Is carbon legit?

Carbon is licensed by the Central bank of Nigeria as a Microfinance bank and customers deposits is insured by the Nigeria deposit insurance commission (NDIC)

Conclusion: FairMoney vs Carbon

Range of services

FairMoney and Carbon are fintech apps in Nigeria that offer a wide range of solutions from digital banking to digital lending to savings to other Value added servies such as airtime and bill payment.

Interest Rate

Fairmoney has 2.5% – 30% interest rates on their loans while carbon also has 2.5% – 30% interest rates on their loans with the same loan amount of ₦2500 – ₦1,000,000.

Loan Amount

Fairmoney has 2.5% – 30% interest rates on their loans while carbon also has 2.5% – 30% interest rates on their loans with the same loan amount of ₦2500 – ₦1,000,000.

Savings

Fairmoney has a savings feature that offers interest rate at 9% per annum wile carbon offers interest rate as high as 15.5% interest rate if the money if the amount saved is fixed for a pre-defined period of time.