Flutterwave vs Paystack: A battle of payment giants.

Table of Contents

Flutterwave vs. Paystack: A Comprehensive Comparison for Nigerian Use Cases

In the rapidly evolving world of digital payments, two platforms stand out in Nigeria and beyond: Flutterwave and Paystack. Both companies have not only revolutionized the way businesses handle transactions but have also set new benchmarks for operational efficiency and reliability. This article delves into a detailed comparison of these two fintech giants, highlighting their histories, unique features, Nigerian use cases, and global reach.

Striking Histories: The Journey of Flutterwave and Paystack

Flutterwave

Founded in 2016 by Iyinoluwa Aboyeji and Olugbenga Agboola, Flutterwave set out with a vision to simplify payments for endless possibilities. The company quickly gained prominence for its ability to offer seamless and secure payment solutions across multiple channels.

Key Milestones:

– 2017: Secured $10 million in Series A funding led by Greycroft Partners and Green Visor.

– 2020: Raised $35 million in Series B funding, expanding its operations significantly.

– 2021: Achieved unicorn status with a valuation surpassing $1 billion after raising $170 million in Series C funding.

Overview of Flutterwave

Flutterwave is a payment technology company that provides seamless and secure payment solutions for businesses across Africa. Founded in 2016, it has quickly become one of the leading payment gateways on the continent. The following are the services flutterwave provides:

– E-commerce: Allows online stores to accept payments from customers around the world. It does this by allowing users to create virtual cards for online transactions. This virtual card created by flutterwave was known as Barter.

In 2017, Flutterwave, a Pan-African fintech startup, teamed up with Visa to launch Barter (initially called GetBarter), a virtual card service aimed at facilitating personal and small merchant payments within Africa and across borders.

However, after a year-long hiatus to revamp its offerings, Flutterwave announced that Barter will permanently shut down on March 12, 2024, citing evolving customer needs and shifting market trends. Post this date, Barter accounts will become inactive, and users won’t be able to access their funds.

Barter had previously faced challenges, including a temporary halt in July 2022 due to an update with its card provider. Originally launched with Visa, Barter later switched to Mastercard, but reliability issues persisted.

Flutterwave indicated a strategic shift towards optimizing services for businesses and remittance solutions, evidenced by the recent shutdown of another platform, Disha, and the rebranding and global expansion of their Send platform into markets like Canada, the US, and India.

Other services flutter wave provides include:

– Travel and Hospitality: In 2023, Flutterwave announced joining the IATA Financial Gateway (IFG) – an omnichannel payment orchestration and management platform dedicated to the airline industry. The platform allows airlines to receive local payments from local markets through all their distribution channels. E.g Air Peace and travel agencies like Travel wings Nigeria use the platform.

– Education: Enables educational institutions to collect fees online. In this case a strong contender for dominance is REMITA.

– Financial Services: Assists fintech startups in processing payments and managing transactions. Flutterwave has processed over 400 million transactions above $25 billion and serves over one million businesses, including customers like Uber, Airpeace, Bamboo, and Piggy Vest.

Paystack

Paystack was established in 2015 by Shola Akinlade and Ezra Olubi. The startup aimed to transform online payments in Africa with a focus on ease of use and reliability, catering specifically to Nigerian businesses.

Key Milestones:

– 2016: Became the first Nigerian startup to be accepted into the Y Combinator accelerator program.

– 2018: Processed over 15% of all online payments in Nigeria.

– 2020: Acquired by Stripe for $200 million, marking a significant milestone in the African tech ecosystem.

Overview of Paystack

Paystack is another major player in the African payments landscape, established in 2015 and later acquired by Stripe in 2020. It offers a robust payment solution tailored specifically for the Nigerian market. The following are the key features of paystack.

- Local Focus: Highly optimized for Nigerian businesses with extensive support for local payment methods.

- User-Friendly Interface: Intuitive dashboard for managing payments and tracking performance.

- API Integration: Easy to integrate with websites and mobile apps.

- Recurring Billing: Supports subscription services with automatic billing.

- Customer Support: Renowned for excellent customer service and support.

Other key partners using paystacks services include:

– SaaS Companies: Ideal for software-as-a-service businesses needing subscription billing.

– Online Marketplaces: Supports payments for marketplaces connecting buyers and sellers.

– Freelancers and Small Businesses: Provides tools for invoicing and accepting payments.

– Non-profits: Facilitates donations and fundraising activities.

Paystack vs Flutterwave

The following are the differences between Paystack and flutterwave based on their unique features.

Integration and Ease of Use:

-Flutterwave: Known for its robust and developer-friendly APIs, makes integration seamless for various platforms, including mobile and web applications.

– Paystack: Also offers easy integration but is particularly lauded for its intuitive interface, which makes it accessible even for non-developers.

– Local Optimization: Both are optimized for Nigerian businesses, supporting local payment methods like USSD, mobile money, and bank cards.

Payment Methods:

– Flutterwave: Supports a broader range of payment methods, including international options like PayPal, in addition to local payment methods.

– Paystack: Primarily focuses on local payment methods, which makes it exceptionally suited for Nigerian businesses.

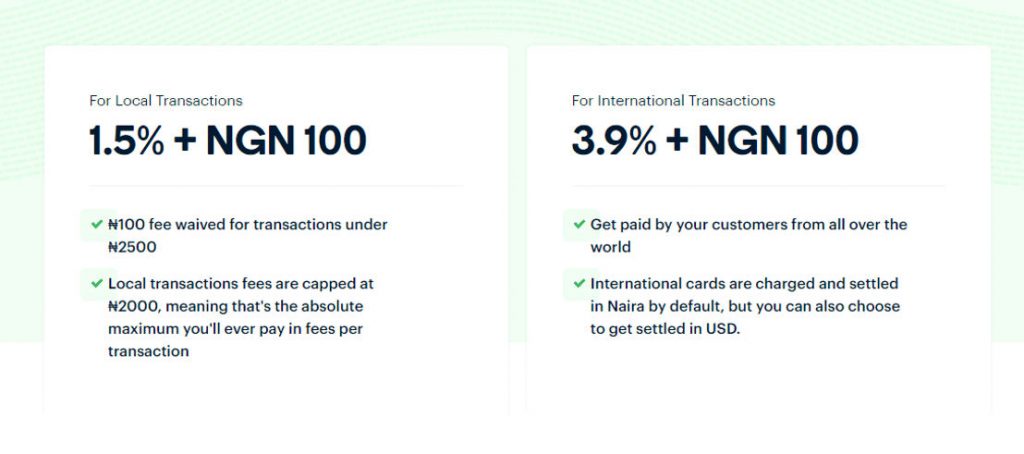

Pricing:

– Flutterwave: Charges 1.4% per transaction for local payments and 3.8% for international transactions.

– Paystack: Charges 1.5% + ₦100 for local transactions and 3.9% + ₦100 for international transactions. The ₦100 fee is waived for transactions under ₦2,500.

Customer Support:

– Flutterwave: Offers 24/7 customer support but has received mixed reviews regarding responsiveness.

– Paystack: Known for excellent customer service with quick response times and effective solutions.

Security:

– Both platforms adhere to stringent security protocols, including PCI-DSS compliance, ensuring that user data and transactions are secure.

Nigerian Use Cases and Suitability

Flutterwave:

– E-commerce Platforms: Given its global reach and multiple currency support, Flutterwave is ideal for Nigerian businesses looking to scale internationally.

– Large Enterprises: Its extensive feature set and robust infrastructure make it suitable for larger organizations with complex payment needs.

Paystack:

– Startups and SMEs: The user-friendly interface and local payment optimization make Paystack a great choice for small to medium-sized enterprises.

– Subscription-Based Services: With its efficient recurring billing system, Paystack is perfect for SaaS companies and other subscription services.

– Online Marketplaces: Enables seamless transactions for online marketplaces.

– Non-profits: Simplifies donations and fundraising activities.

Global Reach and Expansion

Flutterwave:

– Countries: Operates in Ghana, Kenya, South Africa, Uganda, Zambia, and more.

– Currencies: Facilitates transactions in USD, GBP, EUR, NGN, KES, ZAR, and over 30 currencies (both local and international currencies)

– Partnerships: Collaborates with Uber, Booking.com, and Flywire to enhance service offerings.

Paystack:

– Countries: Predominantly focused on Nigeria but also active in Ghana and South Africa.

– Global Integration: Stripe’s acquisition has enabled deeper integration with global payment systems.

– Transaction Volume: Processes millions of transactions monthly, serving over 60,000 businesses.

Nigerian Banks and Companies using these Services

Flutterwave:

– Banks: Access Bank, GTBank, Zenith Bank.

– Companies: Jumia, Konga, Flywire.

Paystack:

– Banks: First Bank, United Bank for Africa (UBA), Ecobank.

– Companies: Betway, Jobberman, Domino’s Pizza Nigeria.

Competitors in Nigeria and Beyond

Competition always exists in the world of business and finance. Here are the top rivals of flutterwave and paystack.

Local Competitors:

– Interswitch: Offers comprehensive digital payment solutions.

– Remita: Facilitates payments and collections for individuals and organizations.

International Competitors:

– Stripe: Global payment processing with a strong developer focus.

– Square: Provides a wide range of payment and point-of-sale solutions.

– PayPal: Widely recognized for its global payment capabilities.

Choosing between Flutterwave and Paystack largely depends on the specific needs of your business. For companies aiming for international expansion and requiring a versatile payment gateway, Flutterwave is a solid choice. Conversely, for businesses focused on the Nigerian market with a need for simplicity and excellent local support, Paystack stands out.

References