Cashenvoy vs Paystack

This article is a comprehensive head to head review of two payment processors, Cashenvoy and Paystack.

These has been so much buzz around paystack and its recent acquisition by stripe is a lot of validation to the capability of the startup in payment processing. However, Nigeria has a very innovation payment space that ensure that Paystack is not left to harvest all the customers to themselves, how do they stack up against other payment processors.

Table of Contents

Introduction

Paystack boasts of having the best transaction success rates in the industry with a bold claim that “If a transaction fails on Paystack, it’s improbable it’ll work anywhere else.”

The Startup achieves this transaction success rate by

- Direct Bank Integrations

Paystack is directly integrated into some of Nigeria’s largest banks, ensuring a near-100% success rates for many card transactions. - Intelligent Routing

Paystack dynamically routes transactions through different gateways and processors, ensuring optimal payment pathways, and high success rates.

CashEnvoy is a payment service that allows businesses receive payment online. The payment platform commenced operations in November 2009. Websites that integrate with CashEnvoy can accept payment from all the major Nigerian debit cards, international Visa/Mastercards and also from the CashEnvoy wallet.

CashEnvoy is owned by E-Settlement Ltd, an independent, private sector led, limited liability company located in Lagos, Nigeria focused on providing Innovative, Dependable, Easy-to-use, Affordable and Secure payment solutions.

CashEnvoy is approved by the Central Bank of Nigeria (BPS/PSP/GEN/PSM/02/010) to process web transactions and a member of Electronic Payment Providers Association of Nigeria

Core Offerings

Paystack

Below are features that make paystack stand out as a payment processor.

Payment Processing

Paystack allows users to accept payments from customers both locally and internationally. Paystack supports Card, Bank Account, Bank Transfer, USSD, Visa QR, Mobile Money.

The platform does NOT have point of sale terminals(POS) yet!

Payment Pages

With paystack , payment collection is made easier with payment pages that can be customized for particular products. These pages ca provide final descriptions about the product and serve as landing age to creat a better user experience for customers.

Invoices

Paystack allows users to send invoices to customers easily, this helps create a professional feel to the process of accepting the payment

Recurring Biling

Recurring billings allows you to bill users recurrently as payment for a subscription. This feature reduces the clumsiness in processing the same set of payment over and over again.

Custom Payments

Paystack has well-documented APIs that allows developers to build everything from simple projects to complex financial solutions that can serve thousands of customers.

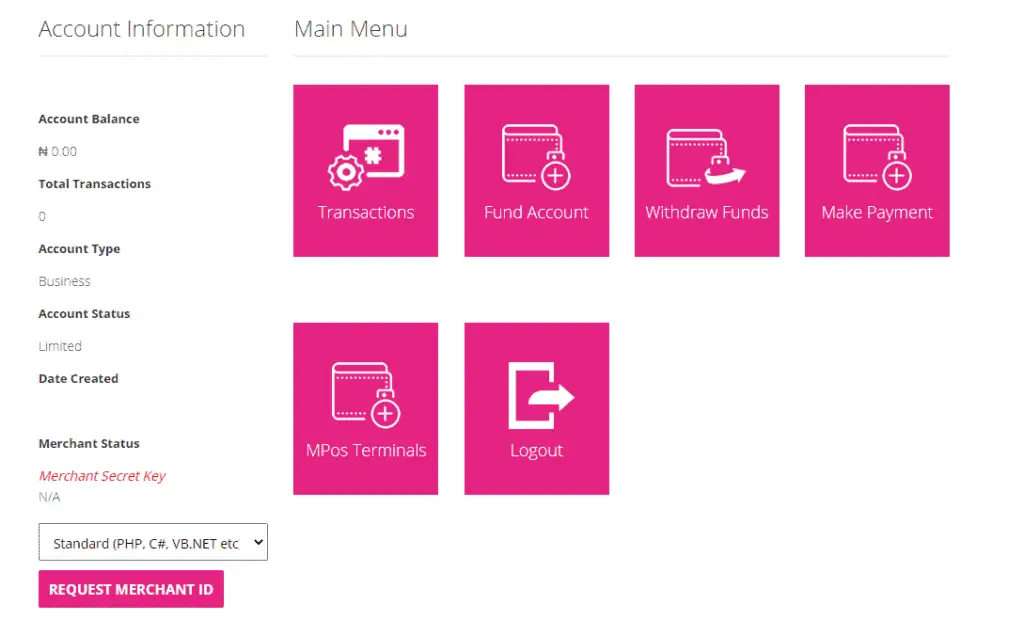

Cash Envoy

CashEnvoy has two major types of classifications for customers, personal and business.

| Features | Personal Account | Business Account |

| Send Money | Not Applicable | To Business Account only – Free |

| Make Payments | Free | To Business Account only – Free |

| Receive Payments | Not Applicable | Local: 1.5% + N25.00 | Intl: 3.9% + N12.60 |

| Withdraw funds | Not Applicable | ₦120.00 fee for withdrawals of ₦4,000.00 or less |

Buyers

- CashEnvoy pays you 0.5% of the transaction amount on every transaction.

- Shop online safely and securely from online stores that accept CashEnvoy.

- Fund your account using Interswitch, Verve, Master or Visa cards.

- Make payments using your debit cards (local and international), online banking or bank deposits.

- No setup, daily, monthly or annual charge

Sellers

- Sellers can use cashenvoy to accept payment on their online store via debit cards, internet banking and CashEnvoy wallet.

- Receive payment and donations online with ease.

- Easy to use, with complete transaction records.

- No integration or subscription fees!

- Easily pay and settle other merchants on your platform.

Limitations of Cash Envoy

CashEnvoy can be used to make and receive payments over the internet. CashEnvoy can be used only on merchant websites that accept CashEnvoy.

How does Cashenvoy work?

By integrating CashEnvoy on your site, you can accept payment from multiple payment channels like the CashEnvioy wallet, debit cards and mobile money.

Funds are transferred securely through CashEnvoy and money is deposited into the seller’s CashEnvoy account. Funds can only be withdrawn by CashEnvoy verified merchants.

CashEnvoy vs Paystack

Cashenvoy has a distinctive buyer and seller profile where the seller account is eligible to accept payments while the buyer account cannot.

For paystack this distinction is literally absent and all user accounts are treated as